기존 LAA에서 QQQ를 애플('AAPL')로 변경한 포트폴리오

| Metric | Strategy | Benchmark(SPY) |

| Cumulative Return | 949.37% | 391.8% |

| CAGR﹪ | 14.15% | 9.38% |

| Max Drawdown | -16.48% | -53.0% |

| Longest DD Days | 577 | 1583 |

| Volatility (ann.) | 48.78% | 72.97% |

| R^2 | 0.35 | 0.35 |

| Information Ratio | 0.08 | 0.08 |

| Calmar | 0.86 | 0.18 |

| Skew | -0.07 | -0.75 |

| Kurtosis | -0.28 | 2.39 |

| Expected Monthly | 1.1% | 0.75% |

| Expected Yearly | 13.17% | 8.75% |

| Kelly Criterion | 33.5% | 27.19% |

| Risk of Ruin | 0.0% | 0.0% |

| Daily Value-at-Risk | -3.9% | -6.71% |

| Expected Shortfall (cVaR) | -3.9% | -6.71% |

| Max Consecutive Wins | 8 | 15 |

| Max Consecutive Losses | 8 | 5 |

| Gain/Pain Ratio | 1.52 | 0.66 |

| Gain/Pain (1M) | 1.52 | 0.66 |

| Payoff Ratio | 1.42 | 0.83 |

| Profit Factor | 2.52 | 1.66 |

| Common Sense Ratio | 4.53 | 1.85 |

| CPC Index | 2.17 | 0.92 |

| Tail Ratio | 1.8 | 1.12 |

| Outlier Win Ratio | 2.92 | 2.84 |

| Outlier Loss Ratio | 5.24 | 2.58 |

| MTD | 2.34% | 0.0% |

| 3M | 2.1% | -0.47% |

| 6M | -2.23% | -8.02% |

| YTD | -4.12% | -12.87% |

| 1Y | 2.19% | -4.79% |

| 3Y (ann.) | 14.81% | 14.45% |

| 5Y (ann.) | 12.52% | 12.82% |

| 10Y (ann.) | 9.77% | 13.67% |

| All-time (ann.) | 14.15% | 9.38% |

| Best Month | 8.04% | 13.44% |

| Worst Month | -8.5% | -16.52% |

| Best Year | 35.39% | 32.31% |

| Worst Year | -4.57% | -36.79% |

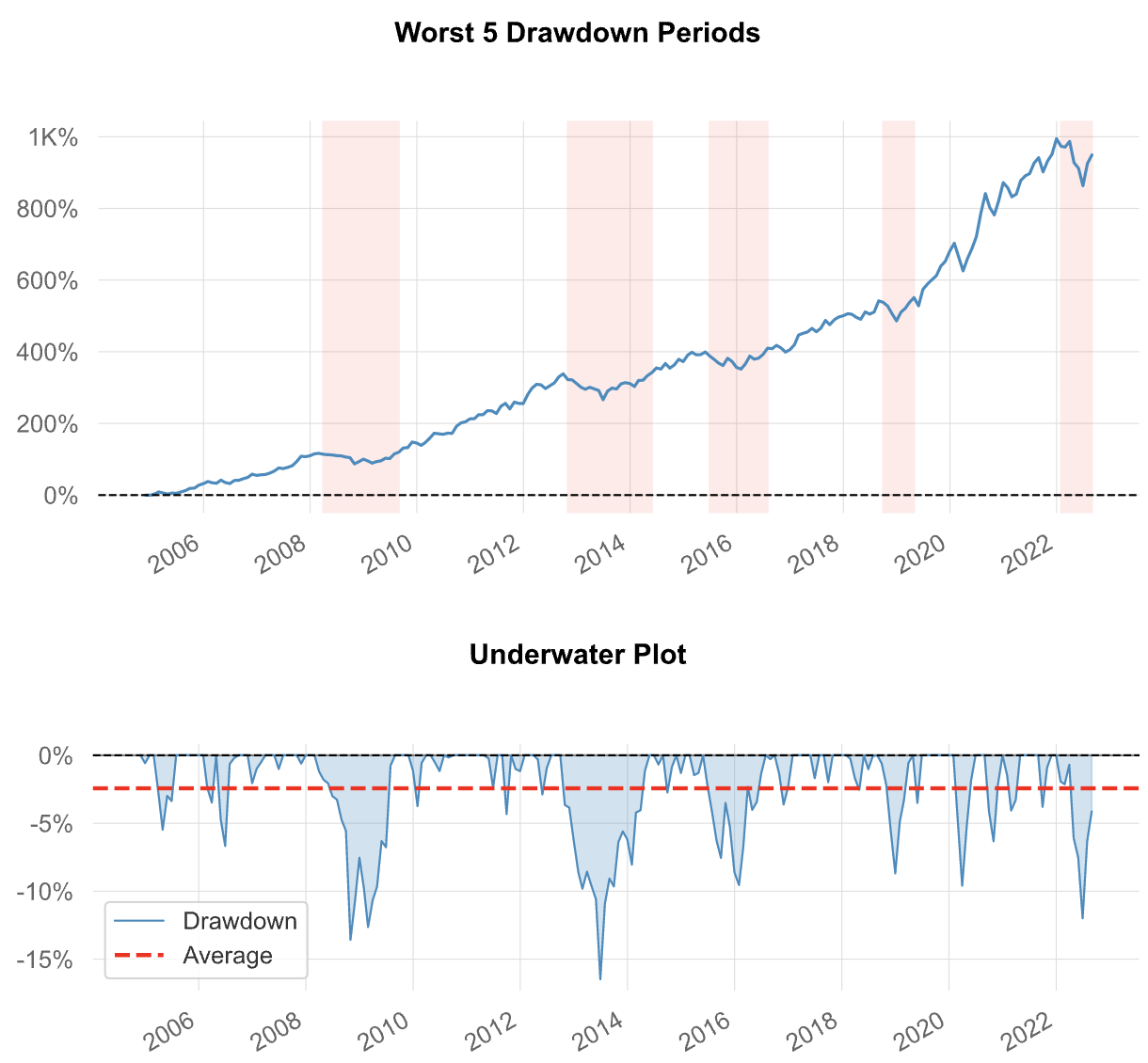

| Avg. Drawdown | -4.13% | -7.0% |

| Avg. Drawdown Days | 110 | 141 |

| Recovery Factor | 57.59 | 7.39 |

| Ulcer Index | 0.04 | 0.13 |

| Serenity Index | 88.64 | 5.91 |

| Avg. Up Month | 3.31% | 3.68% |

| Avg. Down Month | -2.34% | -4.44% |

| Win Month | 61.03% | 66.98% |

| Win Quarter | 69.44% | 75.0% |

| Win Year | 73.68% | 84.21% |

| Beta | 0.4 | - |

| Alpha | 2.05 | - |

| Correlation | 59.15% | - |

| Treynor Ratio | 2400.72% | - |

'자산배분' 카테고리의 다른 글

| 산술평균과 기하평균 수익률의 차이 이해하기 (0) | 2024.09.30 |

|---|---|

| 산술평균과 기하평균: 자산배분의 필요성 (0) | 2024.09.30 |

| Leveraged ADM (0) | 2022.08.02 |

| LAA + VAA combination strategy (1) | 2022.05.31 |

| LAA(Lethargic Asset Allocation) (0) | 2022.05.23 |